With all the new regulations limiting interest rates and late fees on credit products, many banks are making up the difference with new fees for customers. Many people are now switching banks because of frustration over the new fees and decline in services. Before you switch banks, you should consider the potential benefits and the drawbacks.

Process

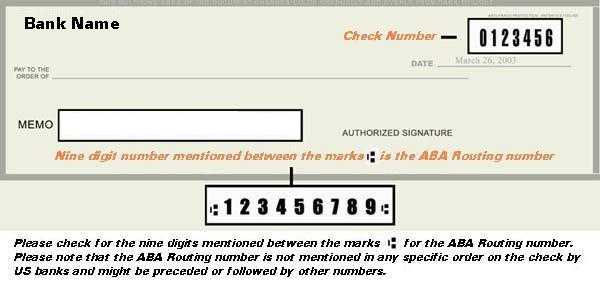

You’ll need to go through the entire process of opening up an account at the new bank and closing the account at your old bank. You will need proof of identity, proof of residence and your banking information for both.

To open a new account, you’ll need to fill out an application and other paperwork at the new bank. The bank may check your name on a system designed to flag customers who owe money on other bank accounts. You can be denied if you owe money to another bank for an old account.

If possible, your best option is to open the new account first. This way, if there’s a problem with the new account or the bank, you will still have access to your old account.

Benefits

If you’re switching because of new or excessive fees at your old bank, you’ll save money by getting the same account type without the fees at a new bank.

The savings from an account switch might be more substantial than you’d think. For example, if your current bank wants to charge an $18 maintenance fee each month for checking and you switch to another bank with free checking, you’ve just saved yourself $432 over the next two years without losing any services.

Customer offers also may save you cash. For example, if your new bank offers lower loan rates to customers than your old bank, you’ll save money in interest should you take out a loan.

A less tangible benefit of bank switching is less frustration. If you’re unhappy with your bank’s service and policies, you’ll be more satisfied with a bank that does things differently.

Drawbacks

The immediate drawback with account switching is the hassle. Opening a new account shouldn’t take long at all, but it’s still paperwork to fill out and time spent. You’re also still risking frustration, as you’re not familiar with the new bank’s customer service yet.

You will have to change the account information for any automatic debits or bill payments you have set up. If you’ve saved payment details on merchant websites, you’ll need to change your account information in those places as well.

Don’t go through the process of switching banks until you’ve confirmed the details for the account type you want at the new bank. Check over the different types of accounts available at a financial website, such as Money Supermarket, so you don’t waste your time on banks that don’t have what you’re looking for.

Article written by Money Supermarket