The general insurance sector in London suffered during the recession and many jobs became redundant. Despite being hit hard, there were still opportunities available for trainee graduates and that has not changed. Now the economic woes are gradually beginning to lift, general insurance jobs in London are becoming available again.

The good news is there are plenty of prospects for anyone looking to go into insurance and salary levels in London are very attractive, especially after a decade in the industry. The key aspects to achieving success in general insurance jobs in London is to be flexible, work hard and be prepared to travel.

Getting started

Hand-on experience in any industry is a key component to finding a permanent position, and is arguably even more important in insurance. Policy and laws can change quickly and the more experience and understanding you have the easier it is to adapt.

It is a good idea to get involved with insurance companies at the earliest possible opportunity and in any position, even if it is only over the summer holidays during the study break. You should also check out the advice and information on discoverrisk.co.uk which provides valuable information about what you can expect from the profession.

Qualifications and personality

To land the best jobs in general insurance you need a four-year degree from an accredited university, although some jobs in insurance require a minimum of A´ levels. A professional qualification ACII meets industry standards that could possibly land you jobs with salaries of £100,000+ once you are established.

The London-market is very relationship driven, therefore good communication and diplomatic skills play a major part in your success. Other soft skills you need are good computer skills, a grasp of law or mathematics and good organisation. As you are likely to be working as part of a team having a sociable nature helps.

Types of jobs in insurance

- Underwriter – An Underwriter determines the terms of a policy and what the relevant figures of payment and compensation should be based on the risk to the insurance company. The position requires initiative and decision making skills and a certain level of technical knowledge to analyze information such as risk reports and health and safety obligations.

- Insurance Sales – Insurance sales is more customer based and requires an in-depth knowledge of insurance policies and the ability to communicate this to a client in a manner that is appealing. Excellent interpersonal skills are a must and persuasive skills will be rewarded with success.

- Insurance Brokers – Insurance brokers are the middlemen between the insurance company offering the policies and the person buying the insurance. Brokers generally specialize in particular area such as shipping or construction where big money is exchanging hands. A good technical understanding of products is required together with excellent negotiation skills.

- Risk Analysts – Risk Analysts evaluate potential areas of risk within a policy that could impact on the earning capacity of the insurance company. The role involves a lot of research into historical records, analyzing statistical methods and using mathematical models.

Claims Inspectors and Loss Adjusters – Claims inspectors and loss adjusters generally focus on complex claims and specialist areas to assess the liability of the policy holder to determine whether the insurance company has to honour the policy. It is one of the more interesting roles in that it requires an element of investigation and site visits. Analysis skill and the ability to make decision based on supporting evidence is essential for this role.

Conclusion

A career in general insurance can be challenging, interesting and rewarding despite the non-glamorous view it is often afforded. Insurance jobs UK specialists, Idex Recruitment, will be able to help you with your London General insurance job hunt. General insurance jobs in the London market are especially interesting as they tend to involve more personal and top-level claims.

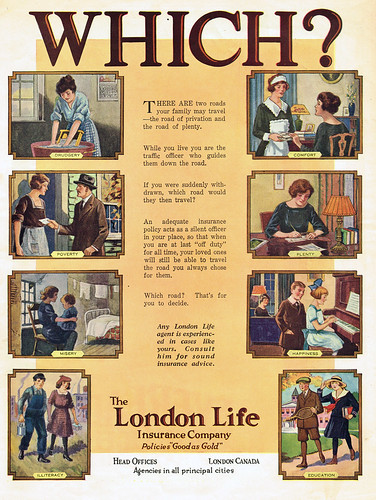

Image Credits: jbcurio and Ronnie23.