Forming an LLC in New York state is actually a really good idea. Especially now where competition is fierce you need a good LLC in order to stay alive, be more competitive and have more security. There are a lot of small companies in New York City and in order for them to become something more they form an LLC.

So why LLC? We keep hearing about LLC but what does it all mean exactly? And how can my business benefit from it? So before you question can be answered, we need to also understand it and why it’s beneficial for you specifically if you have a small business being run regardless of what industry you belong.

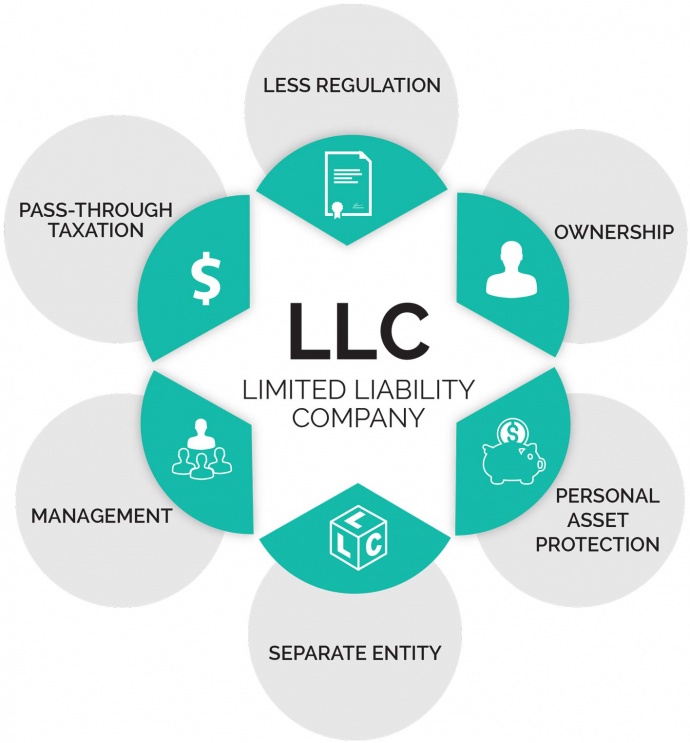

The decision: LLC (limited liability company) helps separate the business from the founders. It may not be a good picture to look at but if you think about defining ownership assets in a losing scenario this is a big help. But before you even consider forming an LLC you need to think about the future, how your move can benefit the company more.

The Liability clause: A corporation and an LLC are designed to protect the personal assets of their founders but by going thru the fine details that we will be able to understand it better. This Is really more on “if things get bad” sort of scenario. If a company will experience financial difficulty the personal and company assets are merged together. But if you formed an LLC or a corporation the two can be separated but their similarities end there. You see corporations may have this separation but it’s not immune to shareholder creditors. For an LLC a creditor can only touch the economic aspect and not the owner giving the owner/ founder control of the company still.

The management: LLC is the informal and the more flexible type, this is because it’s more of a “whatever works” kind of thing. This can’t be applicable to big business since the number of people and the structure needs more specific rules. But with LLC anything is possible because you can just talk it out amongst yourselves.

The Taxation: Taxation will never be out of the picture, with LLC the tax collection is more on the personal side. You the founders and shareholders will have to report your losses/ profit to determine the amount of tax to pay, and this is another structure that you need to look into whether LLC is the best for your interests as a business.

The new companies are the ones that always have these problems. And if you are one you need a good company to help you with this in determining whether an LLC can be fit for your company. Windsor Corporate Services can help you with all of this from identification to the filing. If you don’t know what is the best contact them to clear your thoughts and give you points to determine if an LLC is indeed good for you. If LLC is indeed good for your company’s interest they can help you file it with a peace of mind.